Green tech startups are turning bold ideas into practical tools for today’s climate challenges.

The sector is growing fast, with new solutions emerging in energy, manufacturing, transportation, and waste management. If you want to stay ahead of what’s shaping the future, these are the companies to watch this year.

Green Technology in Simpler Terms

Count on green technology to deliver tools that actively repair or offset environmental damage instead of merely limiting it.

You will see solutions ranging from renewable power and smart grids to advanced recycling and carbon removal, all designed for worldwide deployment.

Why the Sector Is Surging

Demand for climate solutions has grown because governments, investors, and everyday consumers expect progress toward net-zero goals.

You benefit from heightened innovation; however, funding still lags behind the scale of the climate challenge, so every new idea must prove practical and cost-effective to earn backing.

Ten Established Green-Tech Leaders Driving 2025

Learn how large innovators are scaling ideas that once looked niche, paving smoother roads for younger startups to follow.

BYD

Electric cars and buses have already been sold worldwide

- Founded: 2003, Shenzhen

- Workforce: Nearly 300 000 employees

- Why it matters: Three million vehicles produced during 2023 show that battery mobility can hit mass-market volumes without sacrificing profit.

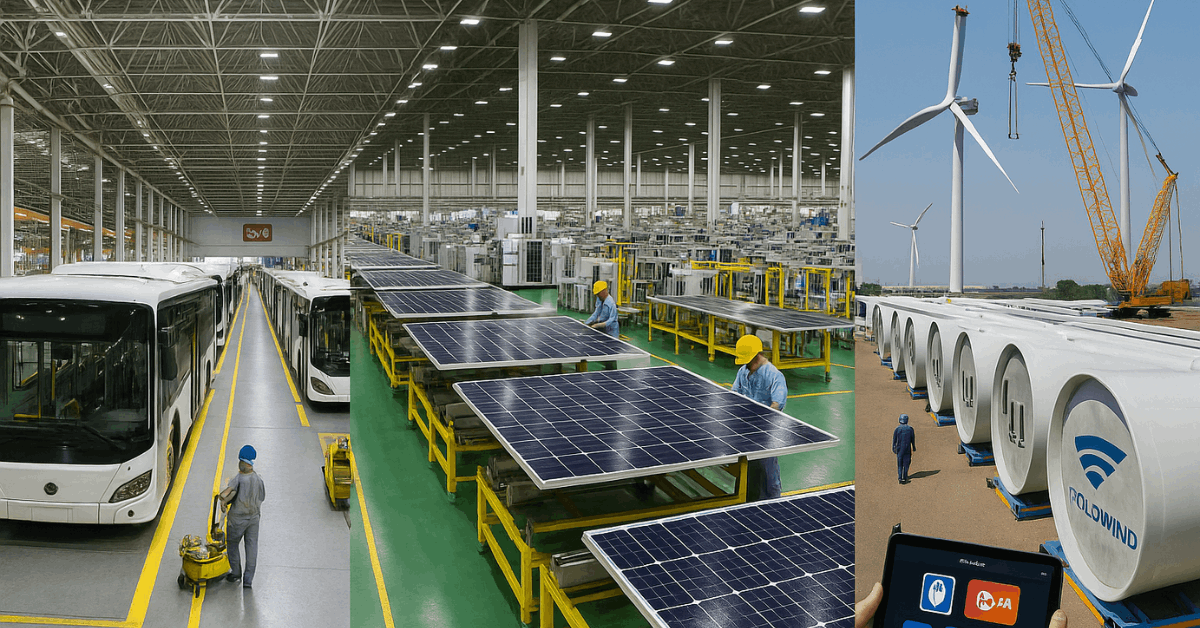

Tongwei Solar

Solar-cell manufacturing at record scale

- Founded: 1992, Sichuan

- Workforce: About 56 000 employees

- Why it matters: Targeting 130 GW of annual cell output positions Tongwei to underwrite more than half of all new global photovoltaic installations.

Tesla

Electric vehicles and stationary batteries sold worldwide

- Founded: 2003, California

- Workforce: More than 100 000 employees

- Why it matters: Market-leading storage products such as Powerwall and Megapack make renewable grids more reliable for utilities and households.

Sungrow

Utility-scale battery storage plus solar and wind inverters

- Founded: 1997, Hefei

- Workforce: Nearly 14 000 employees

- Why it matters: Ten-percent global share of energy storage hardware ensures stiff competition that keeps prices falling.

Antora Energy

High-temperature thermal batteries for industry

- Founded: 2017, California

- Workforce: About 135 employees

- Why it matters: Forty percent round-trip efficiency delivers cleaner heat for heavy manufacturing without fossil fuel burners.

Goldwind

Onshore and offshore wind turbines

- Founded: 1998, Beijing

- Workforce: Roughly 11 000 employees

- Why it matters: Fourteen percent share of the worldwide market underscores wind power’s shift toward Asia-based supply chains.

4Ocean

Ocean-plastic recovery funded by consumer products

- Founded: 2017, Florida

- Workforce: Nearly 200 employees

- Why it matters: More than 35 million pounds of waste collected illustrates how retail demand can bankroll large-scale cleanup.

Brimstone

Low-carbon cement that swaps limestone for silicate rock

- Founded: 2019, California

- Workforce: Fewer than 50 employees

- Why it matters: A chemistry switch that removes sixty percent of cement emissions tackles a sector responsible for almost a tenth of global CO₂.

Climeworks & Carbfix

Direct-air carbon capture and permanent underground storage

- Founded: 2009 / 2007, Zurich / Reykjavík

- Workforce: Over 450 / 58 employees

- Why it matters: A new Icelandic plant capable of locking away 36 000 tons of CO₂ yearly marks a scale jump for negative-emission technology.

Pano AI

Early wildfire detection through 360-degree camera networks

- Founded: 2019, Oregon

- Workforce: Approximately 45 employees

- Why it matters: Rapid alerts sent to firefighters reduce disaster size and keep extra carbon out of the air.

Five High-Potential Startups Worth Tracking

Spotting younger ventures early lets you partner or invest before valuations climb. Each company below shows clear revenue pathways plus measurable climate benefits.

Solugen

Solugen operates “Bioforge” plants that turn corn sugar into hydrogen peroxide, concrete additives, and aviation fuel substitutes. You gain chemicals with a smaller footprint, and cities hosting Bioforges could even achieve net-negative emissions.

NotCo

NotCo’s AI engine, Giuseppe, maps the flavor molecules in animal foods and pairs them with plants such as pineapple or cabbage. You access plant-based milk, burgers, and ice cream that taste familiar while lowering land, water, and methane impacts worldwide.

Jetti Resources

Jetti enables copper extraction from low-grade ore by opening up trapped mineral surfaces. Mines produce more metal per shovel of rock, cutting waste heaps and tailings that often poison waterways.

Enpal

Enpal rents rooftop solar packages—including panels, battery, and smart monitoring—to households that prefer manageable monthly fees over large capital outlays. You avoid upfront cost and still lock in cheaper, cleaner electricity.

Arcadia

Arcadia’s Arc platform cleans and standardizes messy utility data. You can track carbon, verify renewable sourcing, and enroll in community-solar projects without wrestling giant spreadsheets.

Why Corporate Giants Courting Startups Help You Too

Partnering with nimble innovators lets established firms satisfy shareholders and regulators faster than building in-house solutions.

You, as a consumer or investor, benefit when trusted brands integrate credible green features that trim emissions and operating expenses simultaneously.

Shareholder Pressure Accelerates Deals

Large companies face quarterly demands for growth and stronger ESG scores. Partnering with startups offers quicker wins than multi-year R&D projects, so you enjoy new low-carbon products without waiting a decade.

Faster Access, Lower Cost

Integrated green tech usually cuts energy or material waste, shrinking operating expenses for producers. Savings often flow into competitive pricing, and you spend less while shrinking your personal carbon footprint.

Stable Returns on Emerging Tech

Blue-chip balance sheets support pilot funding and guarantee purchase orders. That stability de-risks fledgling ventures, giving you an opportunity to invest in public companies already holding stakes in tomorrow’s climate unicorns.

Obstacles and Openings That Shape Startup Traction

Capital-intensive hardware faces long pilot cycles and the dreaded funding “valley of death” between prototype and mass production.

Yet broader capital pools—ranging from sovereign funds to steel manufacturers—are replacing traditional venture finance, so you may see more climate unicorns emerging outside software-only niches.

Gradual Integration Beats Overnight Disruption

Incremental upgrades often outshine headline-grabbing moonshots because existing supply chains remain intact.

Technologies such as Jetti’s ore-processing catalyst or Solugen’s drop-in chemicals fit current industrial toolkits, meaning you notice real-world impact sooner.

Conclusion

Expect thousands of ventures worldwide to pursue niche improvements that, when combined, will result in significant reductions in greenhouse gases.

Track funding flows beyond electric cars and solar modules, because future breakthroughs may arrive from overlooked corners such as sustainable cement or data-driven energy management.

Staying informed positions you to support, invest in, or adopt the next wave of climate-positive technology long before the 2050 targets arrive.